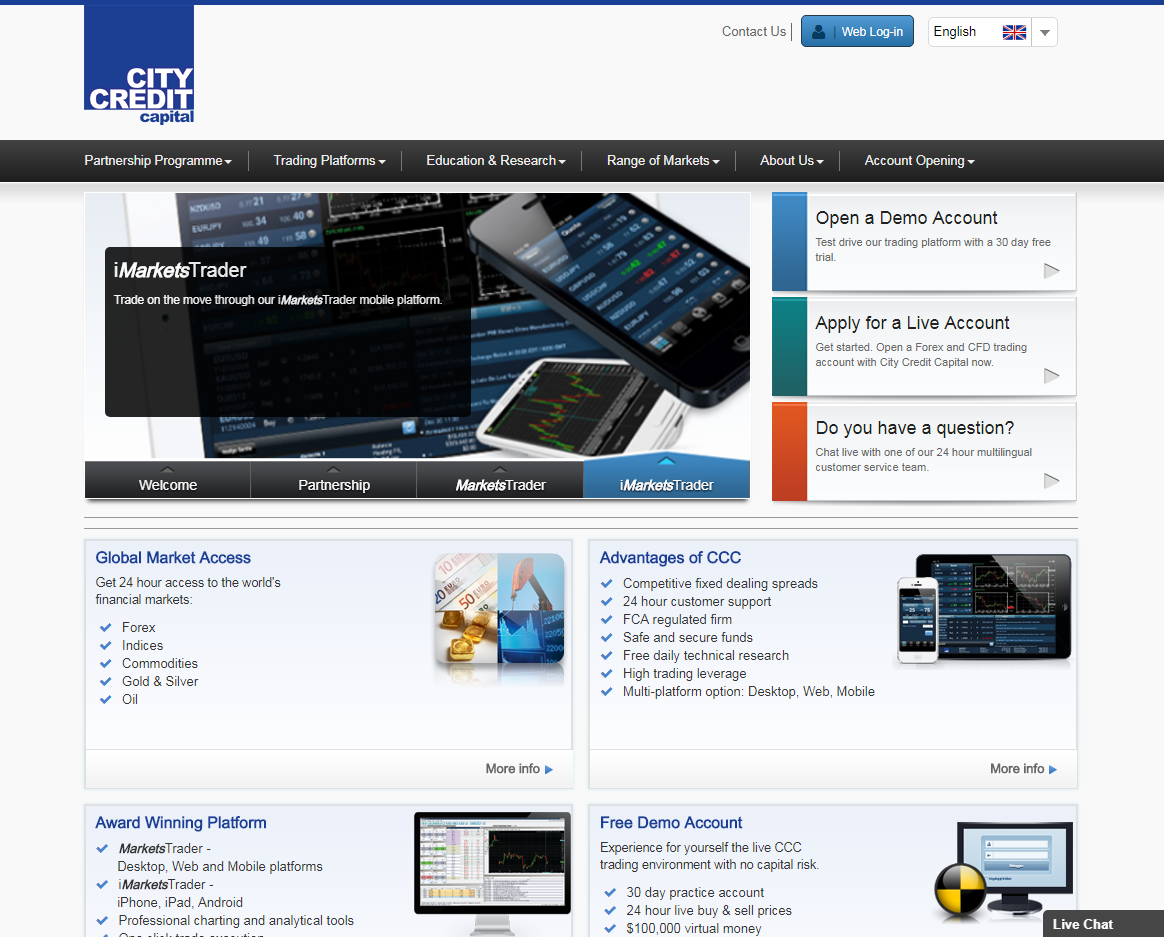

On-line since: About company: City Credit Capital is a regulated by the FCA broker with main office in London. The company was founded in 2001, when the forex industry began to rapidly develop amid the Internet expansion. City Credit Capital, also known as CCC, has gained popularity thanks to its development of unique online services for various clients, from beginning traders to large institutional investors. City Credit Capital mainly deals with currencies, CFDs, stocks, indices, commodities and precious metals, working with clients from around the world, except for the United States. The company has offices in Hong Kong, Brazil, and Chile. City Credit Capital is regulated by the FCA. In addition, the broker is a member of the FSCS program, which ensures compensation up to 50,000 pounds sterling to every trader in case of bankruptcy of the broker. Trading conditions City Credit Capital offers only two types of trading accounts: Mini and Standard. Accounts differ only in the amount of the initial deposit and the minimum lot size. To open the Mini account, you need to deposit $500. Initial deposit for the Standard account is $5,000. CCC is a broker that does not provide ECN accounts, which is a huge disadvantage of the company. City Credit Capital spreads are also higher than average in the industry: 3 pips for EUR/USD. Many other brokers offer spreads below 2 pips for the same pair. Leverage is up to 1:100. Trading platform City Credit Capital has been working in the forex industry for more than 17 years. The broker developed its own trading platform MarketsTrader, which is available for PCs and mobile devices. The MarketsTrader platform is certainly an excellent trading tool, as it is slightly different from the popular MT4 platform. MarketsTrader features user-friendly interface. New clients can also use the CCC demo account to test the platform trading virtual money. Additional services Traders have access to City Credit Capital's educational resources, such as market research, news, analyst comments, professional mapping software. Client support service The broker is focused on providing high quality services to its clients, so it constantly improves the support service. Experienced specialists consult traders 24/5 via chat, email, and phone. Payment methods City Credit Capital offers four different payment methods: bank transfers, bank cards, Neteller, and Skrill. Since the broker is regulated by the FCA, its clients have to go through complex procedure to open an account. Advantages:

Disadvantages:

2/10

(votes 2194)

Tambah komen

Kepentingan broker lain?

7

7

0

0

City Credit Capital's experience isn't good. because their platform isn't executed properly where I want to place my position, it always slippage 10 to 20 pips. That's why I am unable to do scalping trade on the unreliable platform. I have found some suspicious prices too. So I want to warn other traders in the market that check their service first on a demo account.

I have a mini account with City Credit Capital broker. I put $500 as an initial deposit. So far, my trading with City Credit Capital is going good. The platform also works well with useful tools. The best part of City Credit Capital is that they never give any delay for deposit and withdrawal process, they always process it on time. I feel satisfied trading with City Credit Capital.

I've lost almost $500 with City Credit Capital, As I am unable to deal on the MarketsTrader platform due to the fake price and hung issue. I can't open or close any position according to my SL or TP. Also, the doesn't support any EA. So I think City Credit Capital brokers are full of harassment brokers.

A week ago, I opened an account at City Credit Capital. Opening an account was simple and easy and their customer support representative guided me well. Right now, I am trading comfortably and I am opening small lot size trades to minimize the risks as I get adjusted to the market.

They are fine ,most especially on the aspect of customer services. I had been with them almost two years now. I am trading live account with them and no problem. The best part of this broker is that I got lower than 1 pip spread, which is better than the most of the brokers I am with. For me, as an experienced trader it is very convenient.

Trading with City Credit Capital for over a year now and I am so pleased with their services. I have experience with other brokers, and I consider City Credit Capital one of the best. I opened an account with $500 and my first withdraw profit was after 3 months of trading in amount of $760. Since then my profit improved to $400 a month. I trade with them Gold and currency pairs EUR/GBP, USD/GBP and USD/CAD. I never had re-quotes and the spread is stable even during volatility times.

I have tried City Credit Capital broker and certainly they are market maker broker. I observe that they make fast slippage on news publish time. So during the last German Flash Manufacturing PMI news time I traded on EUR/USD pair with them, beside them I also opened trade with other broker. Surprisingly made profit with other broker on their platform but I saw a massive loss with City Credit Capital because they made a fake reversal slippage on their platform of 63 pips. I take a screenshot both trade history as a proof. Now I have no other option, am going to close my account.

Show more

Tambah komen

|

Brokers Reviews

MENCADANGKAN FOREX BROKER

Forex charts and quotes

|

City Credit Capital Ulasan